LATEST UPDATES

Continue Reading

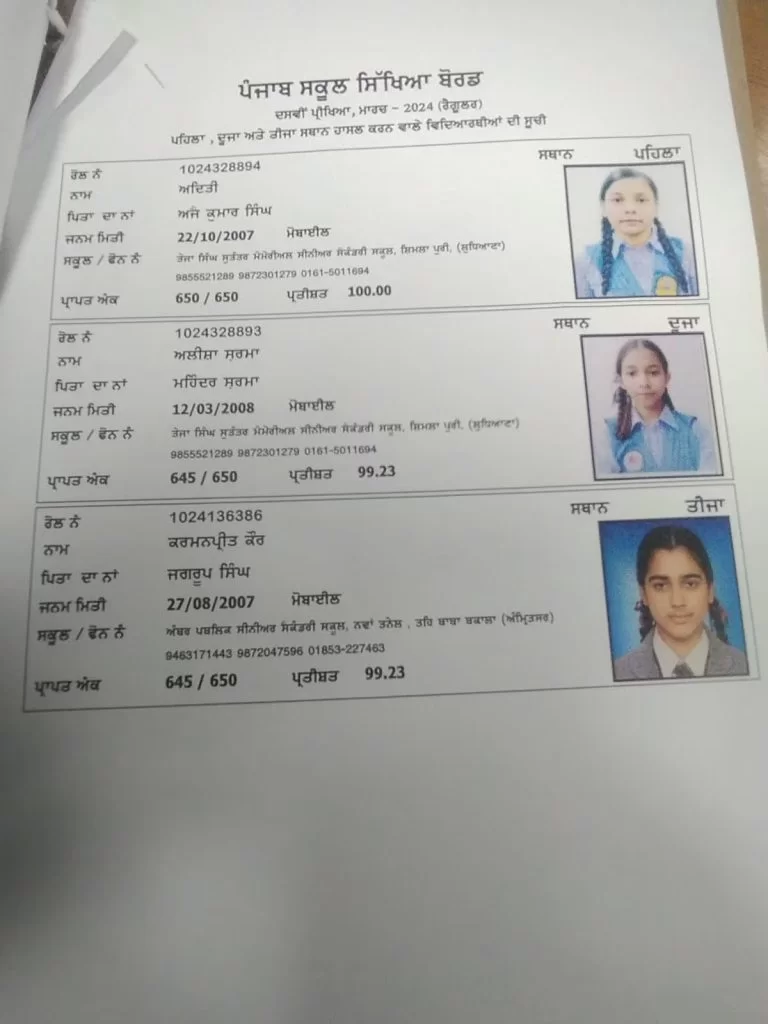

ਲੁਧਿਆਣਾ ਦੀ ਅਦਿਤੀ ਨੇ ਮਾਰੀ ਬਾਜ਼ੀ, ਇਕੋ ਸਕੂਲ ਤੋਂ ਹਨ TOP 2

ਪੰਜਾਬ ਸਕੂਲ ਸਿੱਖਿਆ ਬੋਰਡ (ਪੀਐਸਈਬੀ) ਨੇ 10ਵੀਂ ਜਮਾਤ ਦੀ ਬੋਰਡ ਪ੍ਰੀਖਿਆਵਾਂ ਦਾ ਨਤੀਜਾ ਐਲਾਨ ਦਿੱਤਾ…